The car financing you request for yourself may be different from that which is issued for a financial institution and this may be the case even if they are issued at the same time and with the same information on your credit score. There are indeed different types of credit scores established to meet the various needs of lenders.

A lender may place more weight on certain information, depending on why they are calculating your score. For example, they might want to assess your risk of going bankrupt or determine how eligible you are for a mortgage. Your credit score, however, should always be in the same range as the score established for a lender.

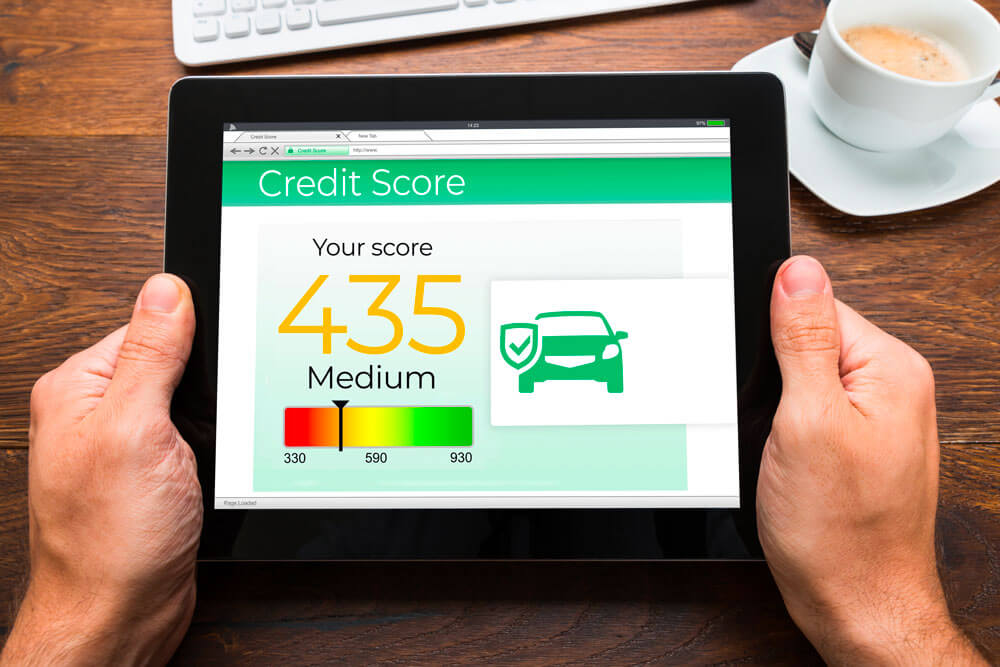

A credit score is a three-digit number calculated using a mathematical formula based on information on your credit file. You get points for transactions you make that show lenders you know how to use credit instruments responsibly, and you lose points for transactions that show you’re having trouble managing credit.

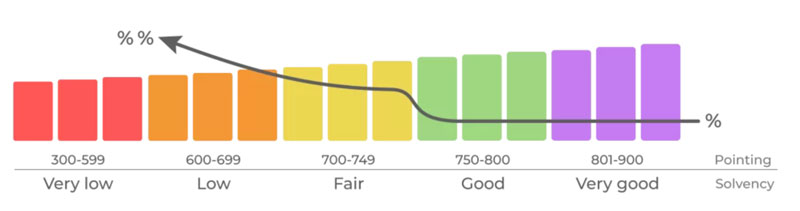

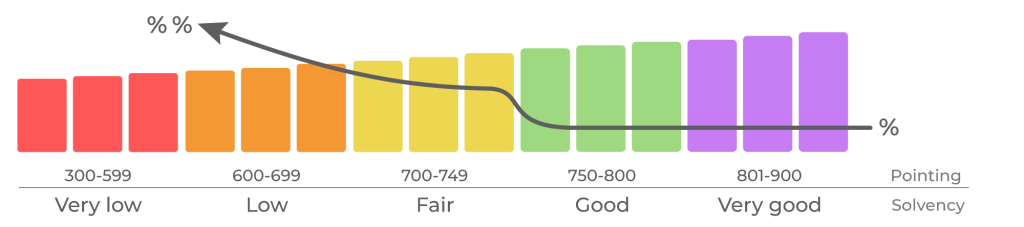

In Canada, credit scores fluctuate on a scale of 300 to 900 points. The best score is 900 points. Lenders and credit reporting agencies establish credit scores using various systems such as Beacon, Empirica and FICO. Your score will change over time based on updates to your credit report. The score obtained online is often the private calculation of the credit agency. For Equifax it has often been referred to as the ERS Electronics Rating Score or Power Score.

Institutions use your credit report and score to determine the risk they would take in lending you money. Each lender sets the lowest score you can have while still being able to borrow money from them. Lenders can also use your score to set your interest rate and credit limit. If you have a high credit score, you may be eligible for a lower interest rate on loans, which can save you a lot of money in the long run.

Credit scores are a very important factor, but it’s usually not the item that lenders consider. Your income, employment and assets also come into play.

395, rue de la Rivière

Cowansville, QC J2K 1N4

395, rue de la Rivière

Cowansville, QC J2K 1N4

Business Hours

Monday 8 am – 8 pm

Tuesday 8 am – 8 pm

Wednesday 8 am – 8 pm

Thursday 8 am – 8 pm

Friday 8 am – 5:30 pm

Saturday – Closed

Sunday – Closed

Follow us on social media

© FMT Performance 2023