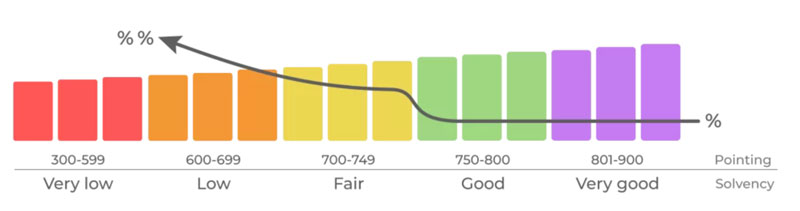

It’s important to always be financially responsible. A good credit score will help you with your mortgage or car loan application! Lets see how to increase your credit score with our tricks and tips.

Be punctual

Pay on time every month. So, when the lender considers opening a new line of credit, like a car purchase for example, they will know that you are not only consciencious but also trustworthy in general. Too many overdue accounts can also hamper these efforts.

avoided by carefully monitoring the balance; So be sure to monitor the monthly increases.

In order to maintain a good credit record, it’s important to keep an eye on your limit! By keeping a low balance compared to what is allowed by the account, you will avoid any negative effects. A high ratio indicates the possibility of going into debt and not paying the full amount owed. This can be avoided by carefully monitoring the balance; So be sure to monitor the monthly increases.

If you have an established credit history, it is important to keep your « old » accounts. Accounts (credit cards / lines of credit) that have been opened for a long time can give more information about the stability of a person’s spending habits. It will likely give higher scores than newly created accounts, as they show up to how well these consumers have behaved throughout their lives until today – even if there is not always new activity on these old accounts!

Pay your credit cards first!

If you need to reduce the amount owed on any type of debt, always reduce what is charged on those cards first. Two reasons: As a general rule, interest rates for credit card purchases tend to be higher than others. Mostly because they are advertised more frequently and can be applied without notice. Also, In addition, if the balance is high, making even one payment for an unforeseen expense may cause anxiety or worry, which may hamper progress in reimbursement of debts.

Having more than one type of credit is good because it will give you a better score. However, if you have too many types of credit, it can hurt your chances of getting loans or mortgages in the future. Some companies may ignore the amount of potential customers’ debt from other sources than their personal finances.

You’re probably wondering how many requests you can get before it affects your credit score. The answer is: as little as possible! Multiple requests for new accounts will not only affect this one, but future loans and scores as well. Try to avoid these requests whenever possible, as they will cost more than what you save by going without an initial line of inquiry.

A good credit report is something that takes time to build and can easily be tarnished. When you think about your reputation, remember this: just because I have access to credit doesn’t mean I have to go into debt!

Need a car loan? Our team can help you regardless of your financial situation.

Questions ? Contact us!